Use Form 1099-NEC to Report Nonemployee Compensation

If you are a business that hires independent contractors, you must file form 1099-NEC to report payments. The purpose is to help ensure everyone pays their taxes.

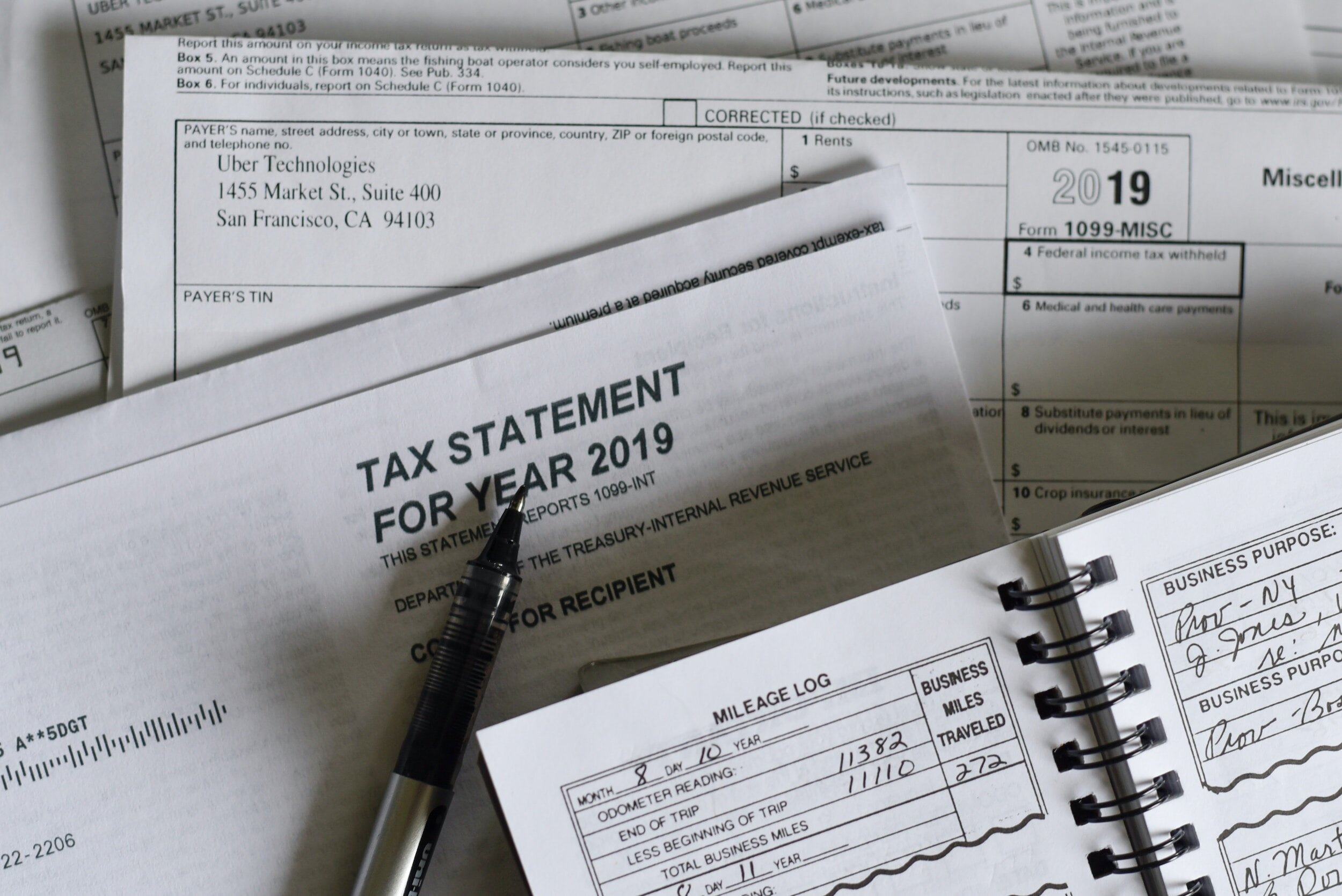

Traditionally, the Internal Revenue Service (IRS) uses the 1099-MISC or miscellaneous income, which is used for awards, prize winnings, and rent. However, the IRS introduced the 1099-NEC (nonemployee compensation) beginning with tax returns filed in year 2021 to categorize several filing requirements deadlines. Businesses use this tax form to report payments given to self-employed individuals, nonemployees and independent contractors.

In the following article, we'll help you understand what is a 1099-NEC and other relevant information.

What Is Nonemployee Compensation?

Non-employee compensation (or self-employment income) is a payment to individuals (not companies) who work for your company. Examples of this are sales commissions, benefits, prices, and awards for services or fees for completing tasks. It also includes remunerations paid to nonemployees, such as independent contractors, freelancers, or service providers (consultants and attorneys).

If a business paid independent contractors at least $600 in a calendar year, they must report it to the IRS through Form 1099-NEC. You should be aware that the compensation must be for trade for business-related purposes, not personal payments. Payments reported on 100-NEC are subject to self-employment tax.

In the U.S., tax law doesn't require business owners to withhold taxes on income for nonemployees. Instead, independent contractors are liable for paying taxes on their self-employment income.

For businesses, it's essential to classify your employees correctly. This way, you can determine whether their income is considered wages or nonemployment compensation. Meanwhile, nonemployees should also pay their tax counterparts in time to avoid penalties.

Who Uses IRS Form 1099-NEC?

Typically, a company can issue a 1099-NEC if the payment for services is:

Payments to individuals who aren't your regular employee

For services rendered in the course of trade or business

For a sole proprietors, partnership, estate, or corporation

At least $600 or more for a year

As per the NEC rule, the form doesn't apply to a corporation like a limited liability company (LLC) or filing tax as an S or C corporation. However, you must file 1099-NEC if you withheld federal income tax under the backup withholding rules, no matter the value.

The following are examples of types of payments you must report on form 1099-NEC:

Sales commissions paid to nonemployees

Payments for independent services, including incidental charges for parts or materials used to perform the services

Professional service fees to attorneys, accountants, and architects, among others.

Sales of consumer products amounting to $5,000 or more

Attorney Exception

If you make payments to an attorney for services, report payments made in Box 1, regardless if it is a corporation or other legal entity. You

Deadlines To File 1099-NEC

Generally, businesses must file this new form by January 31. If January 31 falls on a weekend or holiday, submission is due the next business day. Unless you are suffering from adversity or unexpected hardship, there is no automatic 30-day extension to file. This deadline applies to both paper and electronically filed forms. The electronically filed form deadline is new for 2024.

Who Needs To File an IRS 1099-NEC Form?

As mentioned, a business must file a 1099-NEC if they paid at least $600 to individuals or service providers. The company is responsible for filing a report with the IRS and sending a copy to the recipient or payee. You will send Copy A to the IRS, while you should give Copy 1 and Copy B to the payee. These will serve as their record.

How To File Form 1099-NEC

There are two ways to file the 1099-NEC form: electronic and paper filing. For electronic filing, you must complete the details and submit them. Meanwhile, if you are filing paper returns, print the filled-out forms and mail them to the IRS address in your state. To file 250 or more 1099-NEC forms, you must file electronically rather than on paper.

In general, here is a guideline on how to file the form:

Complete the payee information:Begin with the payee information, such as their name, TIN (Tax Identification Number), address, and other required data.

Validate the details:Before proceeding, it's imperative to double-check the information, especially the TIN. You can useTIN matchingto save time and boost accuracy.

Input your company's TIN:Now it's time to input your entity's information. Like the second step, you should also validate your TIN for accuracy. You also need to write your specific business address.

Enter the amount:Finally, calculate the total amount you paid (Box 1) or federal withholdings (Box 4). Depending on your state, you may need to fill out Box 5 for withholdings for state income tax.

What's the Difference Between Form 1099-MISC and Form 1099-NEC?

The two forms, 1099-MISC and NEC, are similar in the way that they both report income to the IRS. Before the 2020 tax year, companies were using the 1099-MISC form for nonemployees. The said form included a box for non-employee compensation, rents, royalties, fishing boat and crop insurance proceeds, and other related types of income.

In 2020, the IRS introduced the 1099-NEC form to help taxpayers distinguish between different filing deadlines for various payments in the 1099-MISC. Today, it has a single filing deadline for all payments related to non-employee compensation.

Final Thoughts

Whether you are a business or an individual who earns money as a nonemployee, it is crucial to understand everything about the 1099-NEC form. In addition, it's essential to be clear, accurate, and updated in filing your taxes.